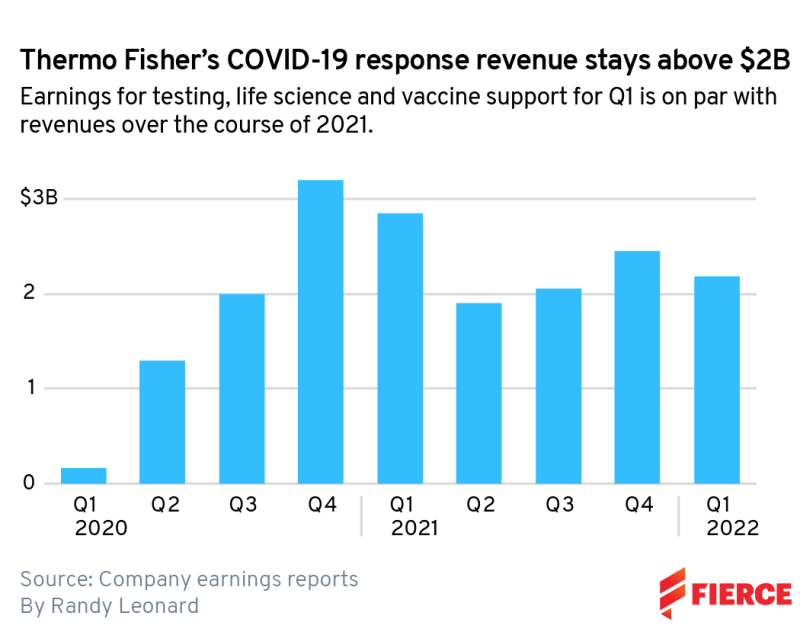

Though higher-than-expected earnings from Thermo Fisher Scientific’s COVID-19 testing business weren’t enough to keep its diagnostics segment from experiencing a sharp year-over-year downturn in the first quarter of the year, that drop was all but invisible in its overall quarterly results thanks to solid growth in each of the company’s other core businesses.

In total, Thermo Fisher raked in $11.82 billion during the period, soaring nearly 20% higher than its revenue during the same three months in 2021, when it took in just under $10 billion.

Last year, COVID testing made up nearly a third of the quarter’s revenues—$2.85 billion of the $9.91 billion total, to be exact. This time around, COVID testing’s share of Thermo Fisher’s total revenue dropped to less than 15%, as its pandemic-related diagnostics brought in $1.68 billion, their lowest take since the first half of 2020.

Those numbers will only continue plummeting, according to Thermo Fisher’s “de-risked” forecast for the rest of the year, as its chief financial officer, Stephen Williamson, outlined on a call with investors Thursday.

“Our guidance now assumes $2.1 billion in testing revenue in 2022, which represents the $1.68 billion delivered in Q1, $225 million in Q2 and then an assumed endemic run-rate level of $100 million in revenue per quarter in the second half of the year,” Williamson said.

Meanwhile, Thermo Fisher has also lowered its expectations for its COVID vaccines and therapies business. Though CEO Marc Casper noted on the call that the business had brought in just under $500 million in revenue for the quarter—“which is what we expected,” he said—while CFO Williamson said the company has reduced the full-year forecast by $600 million, from a $2.1 billion total to $1.5 billion.

Those fast-dropping COVID revenues are being heavily offset, however, by growth in every other department of the company. According to Williamson, in the first quarter, while coronavirus-related earnings drove down the specialty diagnostics segment by 8%, both the life science solutions and analytical instruments businesses saw single-digit percentage growth, and the laboratory products and biopharma services segment reported a monstrous 51% increase for the period.

The latter category includes its clinical research business, the new label for PPD after Thermo Fisher completed its acquisition of the CRO giant at the end of last year. In its new home, PPD brought in $1.66 billion alone for the segment during the first quarter, Williamson said.

With all of that progress, Thermo Fisher is “meaningfully raising our full-year guidance,” Casper said on the call.

“We’re increasing our revenue guidance by $450 million, to $42.45 billion, which would result in 8% reported revenue growth over 2021,” he said. “This guidance factors in our excellent Q1, includes a very strong core business outlook for the remainder of the year and incorporates the expected impact of the recent macroeconomic dynamics.”

Those macroeconomic challenges include the ongoing effects of Russia’s war in Ukraine and renewed COVID lockdowns in China. Together, they amount to a $350 million headwind for Thermo Fisher, according to Williamson.

The company has pledged to continue supporting its employees in both countries, Casper told investors.

“As always, our top priority is the health and safety of our colleagues. We’re supporting our colleagues displaced from Ukraine with a variety of needs, and together with our colleagues globally, we’ve made substantial donations to relief organizations responding in Ukraine and enabling safe haven countries,” he said. “In China, where many of our colleagues are facing lengthy lockdowns and disruption in daily life due to the pandemic, we’re providing care packages to residents in Shanghai who have faced limited food supplies.”

Thermo Fisher has also set aside another $150 million that’ll be doled out as “a special payment this summer” to employees to help counteract the effects of rising inflation in the U.S. and beyond, the CEO said.