Three therapeutics for Alzheimer’s disease steal the headlines at the moment: Eisai and Biogen’s lecanemab, Genentech’s gantenerumab and Eli Lilly’s donanemab.

Yes, we at Fierce Biotech recognize that we contribute to that, but here’s why they’re constantly in the news: They’re the furthest along and best funded, and it is notable to see billion-dollar companies staking their claims on their drugs that—if the disease’s history in the clinic is any guide—are extremely risky.

All three are monoclonal antibodies that target the reduction of amyloid plaques in the brain.

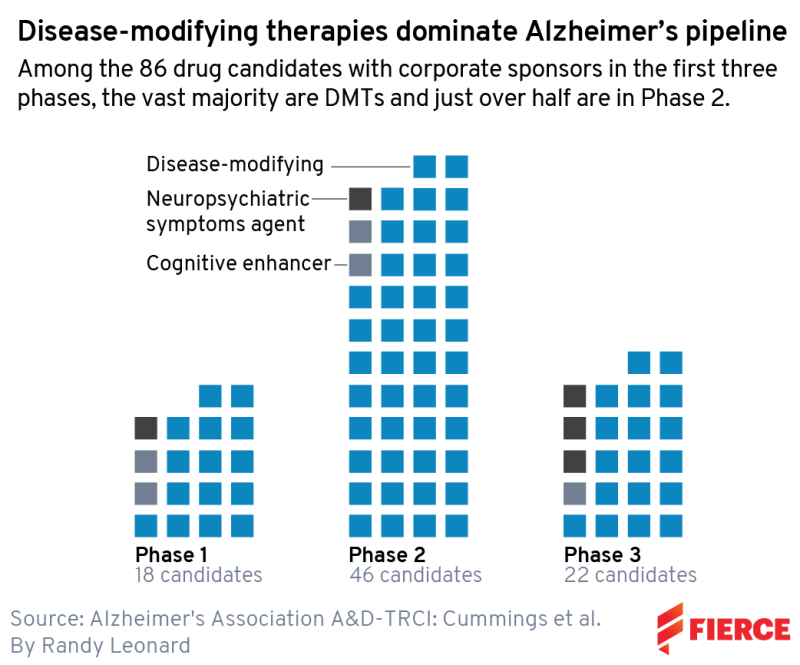

But this story isn’t about them, really. We wanted to show the full breadth of the Alzheimer’s pipeline, and, thanks to a new study from the Alzheimer’s Association (AA), we can do just that. Using data scraped from the ClinicalTrials.gov database, AA found that there are currently 143 drugs in the development pipeline for the devastating neurological disorder—not just three—spread across 172 clinical trials.

Therapies that attempt to actually modify the disease represent 83% of the candidates, and biopharmaceutical companies sponsor half of all the trials and 68% of the late-stage studies. Biologic therapies, particularly monoclonal antibodies, make up 34% of the candidates, and 66% are small molecules that patients can take orally.

The trials listed in the report, if fully enrolled, would involve 50,575 people, or more than 3.8 million participant weeks. This underscores the massive effort underway to find a solution for this disease, which robs people of their memories and cognitive function. It’s not just a couple pharmas here and there.

Below, we provide a snapshot of each clinical stage. In phase 3, there are 31 agents and 47 trials total; phase 2 has 82 agents and 94 trials, and phase 1 features 30 agents and 31 trials.

You won’t see those exact numbers below, though. We focus on biotech here, so of course, we’ve taken AA’s data and narrowed them down to just biopharma companies. We also know that the world of drug development moves faster than ClinicalTrials.gov—which is frankly a triumph among the U.S. government’s data efforts. For instance, we note a phase 2 trial underway for AL002 being conducted by Alector and AbbVie, but we know that AbbVie walked away from that partnership in July.

We’ve eliminated entries that are not defined as drugs or things that are common. For instance, we axed caffeine and THC from the list—but wouldn’t that be wonderful if your morning coffee or other leisurely pursuits could fix your cognitive function?

That’s the future we hope for, but we’ll also take a nice clinically effective IV monoclonal antibody any day if it means more time with our families.

Phase 3

Our Alzheimer’s stars, lecanemab, gantenerumab and donanemab, appear here, which is no surprise.

All three are in late-stage development with critical readouts expected in the next year.

But there are a few more familiar faces, and maybe that’s for all the wrong reasons. The first to note is Cassava Sciences’ simufilam, which has been wracked by controversy over allegations that the company manipulated data in early preclinical research for the drug. There’s two phase 3 studies running for simufilam, with completion dates of October 2023 and June 2024.

The biotech formerly known as Cortexyme, now Quince Therapeutics, has atuzaginstat on the list, with a late-stage trial underway and an estimated end date of December. However, the therapy’s future is up in the air, as under the new Quince banner, the biotech is shopping it around for out-licensing. Atuzaginstat, which aims to reduce Porphyromonas gingivalis infection that is believed to relate to cognitive decline, was placed on an FDA clinical hold earlier this year. It previously failed a phase 2/3 study in November 2021.

An interesting therapy also from the Big Pharma crowd is Novo Nordisk’s semaglutide, marketed for diabetes and weight management as Ozempic. The hope is that the blockbuster therapy could improve nerve cells, inflammation and vascular health to slow the progression of Alzheimer’s. Two studies of the GLP-1 agonist are expected to wrap up in April 2026.

Phase 2

UCB Pharma has an asset called bepranemab in phase 2. The ongoing study features patients with mild cognitive impairment or mild Alzheimer’s and has an estimated end date of November 2025.

This therapy goes after a different mechanism than many of the others we’ve mentioned already: tau. This target, a protein that builds up and tangles in the brain and is thought to contribute to Alzheimer’s, has had about as much luck in the clinic as the amyloid theory so far.

AC Immune and Janssen have similarly placed some chips on the tau bet, with ACI-35. The study is a little closer to completion, with an end date of October 2023. The companies are hoping the tau-targeting vaccine will spur induction of antibodies that attack a type of tau, preventing the tangles from forming.

Often when we see a clinical failure in Alzheimer’s, the company will point to a subgroup analysis from the study to try to make the case for success. That’s exactly what Athira Pharma did in June when fosgonimeton failed to improve working memory and memory processing speed, missing the main goal of the trial. Nevertheless, Athira hailed the data as “very encouraging.” As for our list, fosgonimeton is named in three midstage studies with end dates in October 2022, so maybe we’ll hear more this year.

Phase 1

Our phase 1 list is a little smaller than the others. The one that sticks out to us is Lilly’s LY3372993 because the Indianapolis pharma just revealed its name: remternetug.

The monoclonal antibody is a follow-up to donanemab that Lilly has referred to as a "next-generation anti-amyloid antibody.” Since we haven’t really seen a first-generation anti-amyloid antibody (sorry, Aduhelm), we’ll want to see some hard data on this one. That could be coming next year for the phase 1 we have listed, which has a completion date of September 2023.

Acumen Pharmaceuticals rode the wave of goodwill that immediately followed the approval of Biogen and Eisai’s Aduhelm in summer 2021 to an IPO that raised $160 million. The funds would go toward ACU193, an antibody that targets amyloid-beta oligomers that was originally developed in a collaboration with Merck that ran from 2003 to 2011.

The IPO helped move ACU193 into the clinic, which our list has with an estimated end date of December 2022.